Blog

Learn how to check if a phone number is real before outreach. Discover manual tips, tools, and best practices to verify ...

Learn 7 proven strategies on how to obtain cell phone numbers for your business. Build trust, stay compliant, and boost ...

Explore the differences between B2B telemarketing and SMS marketing. Discover how phone number validation boosts engagem...

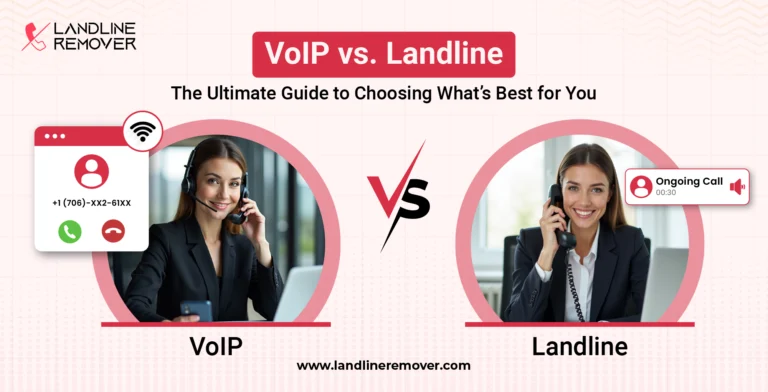

Explore the complete guide on VoIP vs landline for business. Understand benefits, costs, and features of a business land...

Use phone carrier lookup to check number types and lookup phone number provider. Save SMS credits, improve delivery rate...

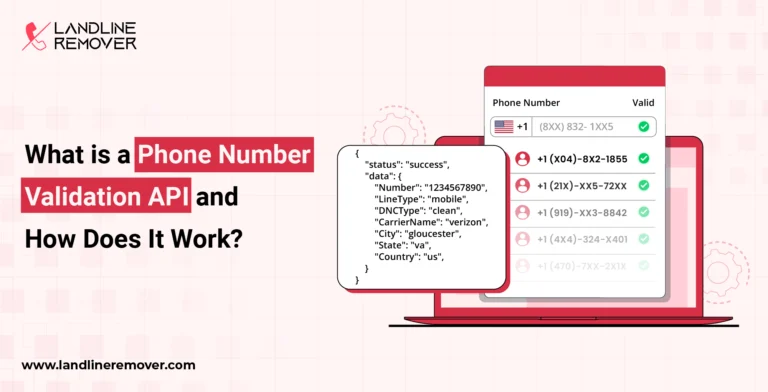

Boost engagement & reduce patient no-shows with a Phone Number Validation API. Ensure real-time, accurate contact data f...